We cannot escape the talk in the media about rising building costs. Even buying a tin of paint for a DIY job at home has become staggeringly more expensive over the last few years.

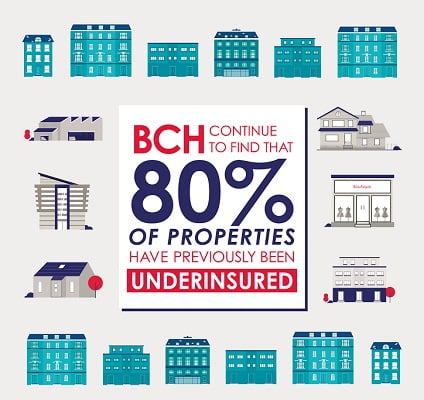

Part of our brief at BCH is to ensure that rising costs are reflected in our building reinstatement cost assessments for insurance purposes (RCAs for short). It is important that the value stated by the policyholder at the start of the policy is accurate and up to date. If not, then at the time of claim, the impact could be severe, as the claim could be reduced in proportion to the amount the true value bears to the value declared in the policy (known as pro rata settlement or Average).

Why has inflation taken off now?

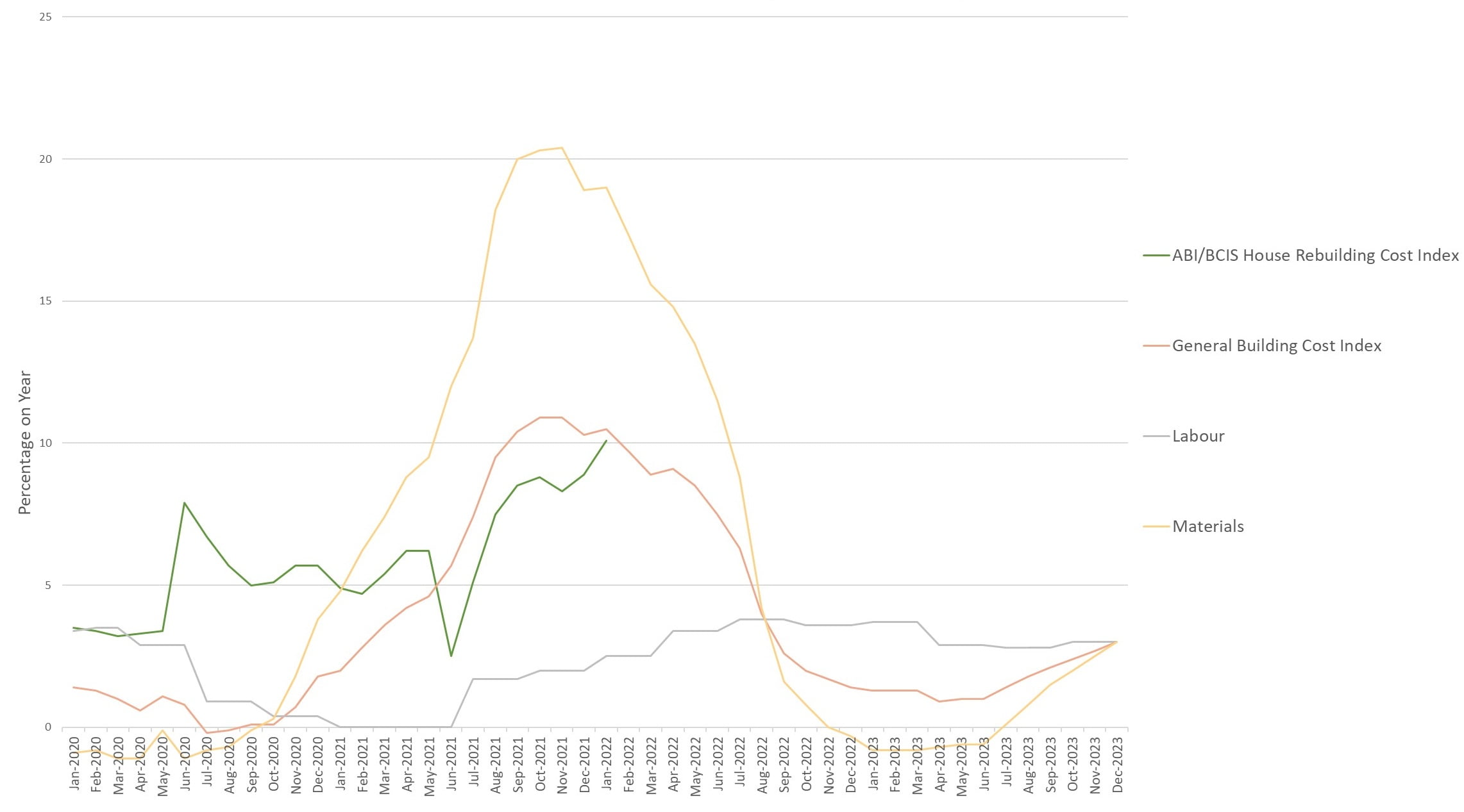

Thinking back before the pandemic, there was talk of the impacts of Brexit being felt in the construction industry. BCIS (Building Cost Information Service part of RICS) gave three scenarios, the best, worst and most likely impact on construction activity and cost inflation. The cost drivers were predicted to be, losses of labour and potential delays in obtaining materials from the EU Bloc. When Brexit eventually happened, predictions became reality as the construction industry lost a substantial number of its overseas workers and had restrictions on imports from the EU.

Then in early 2020, the pandemic struck. Inevitably, construction activity took a sharp decline but rose relatively quickly throughout the summer of 2021. Early restrictions were, of course, imposed, and many construction sites had to significantly change working practices to ensure worker safety.

By March 2021, monthly output exceeded pre-pandemic levels – compounding issues that had been building throughout 2020. When demand exceeds supply, prices for labour and materials go up and lead times are delayed. Unusually and unlike previous construction cycles, the drivers of increased costs, were acute not only in the UK, but worldwide. The impact was massive, from the price of timber and carpenters, to plaster and plasterers and so on.

2021 saw a few more acute factors adding to the pressure on inflation including fuel costs, a shortage of HGV drivers and the ongoing effects of the pandemic. Contractors in fixed priced contracts were left to ‘absorb’ increased costs. History shows that this will lead to contractual disputes and delays in completions. There is also evidence of larger companies stockpiling materials. Speculating in this way was a sound move, but the result was a reduction in supply and rationing/shortages of supply for the wider market, particularly smaller sized contractors.

Combining this with the reduction in manufacturing capacity both here in the UK and overseas and the ability to transport materials, a substantial rise in cost was the outcome, as demand outstripped supply.

Happy New Year-2022!

So, 2022 arrived and we ‘welcomed’ a new style of lockdown. True, buildings carried on getting built, but severe supply issues for labour and all components, raw materials including fuel, remained with us. We have reached a pinch point. Key indicators are that tender prices are rising at a speed not seen for many years.

Mark Fowler, Director of MDA Consulting, one of BCH quantity surveying partners, summed the situation up recently:

“In terms of how building costs and tender prices increased during 2021, it was interesting to see that a lot of data / commentators (including ourselves) were – at the beginning of 2021 – forecasting increases for the year in the region of 1% to 2.5%.

In reality, those same commentators have reported actual increases of anywhere between 4% and 6.5% (and the BCIS have reported 6.7%), so there has clearly been a far greater impact on both building costs and tender prices than most people were envisaging.”

Cost increases and shortages of certain materials have been widely publicised, and there is plenty of evidence that certain timber and steel components too have risen in excess of 50-70% through 2021.

But we must remember, when putting together a rebuilding cost value for insurance purposes, that different building construction methods could mean that one type of property has been more severely affected by inflationary factors, than another. This is addressed by a detailed RCA or Benchmark but is commonly overlooked by generalised indexation. A bespoke assessment recognises the fact that few buildings are ‘average’ and thus, basing assessments that value on average building costs, could leave a policyholder significantly underinsured, or in some cases overinsured.

Looking Forward

If 2021 was a surprise to most, how can we confidently comment on what’s to come?

At the time of writing, the headline inflation rate was announced at 5.4% which is the highest for 30 years. Predicted to go to 6-7% before levelling off in the summer. BCIS, currently reporting a 40 year high on materials costs, are commenting that it is likely that the pressure on material prices and availability will continue throughout 2022 but, that the major driving impact this year is likely to be further labour shortages.

Mark Fowler, further stated:

“It is interesting to see that the BCIS are currently forecasting increases for 2022 of between 1.5% and 3.5% – however, combined with the well-documented issues relating to Brexit, Covid, increases in transport and logistics costs, and ongoing uncertainty about energy/fuel tariffs, it is difficult to forecast with certainty what this might mean for tender prices during 2022.”

What is clear, is demand is exceeding supply, across many areas. The result is price increases. In time, if prices go up too much, demand will reduce as people push back projects. BUT, with insurance claims you don’t have the ability to delay decisions on the project, the project be it repair or rebuild must proceed quickly, to help businesses and families return to normality and the market rate at the time of loss, however high, has to be paid.

The Impact on Insurance and the Insured

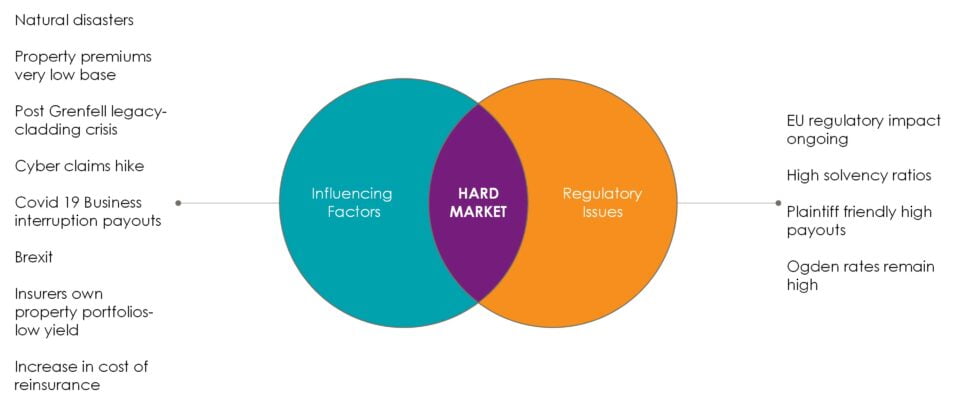

In one of our most recent articles, BCH Director Martyn Barrett talked about the ‘hard market’ in insurance and what it meant for all stakeholders in the insurance process. Premiums are rising and a tougher stance is being taken on underinsurance in claims settlements. There is never a good time to be underinsured, but the climate is tougher now than ever. A significant rise in inflationary pressure on claims costs will only lead to even to more scrutiny of the claim and as part of that process the validity of the base sum insured set at policy inception.

It may well be short-lived but a policyholder could be caught out should major loss occur in a period of cost inflation. The Sum Insured could be completely exhausted even with an inflationary uplift built into the policy provision. Standard inflationary uplifts may not be enough, particularly if there is a complex building with a long reinstatement period. In short, the base figure must be right from inception.

As the experts in insurance rebuilding costs and how they relate to policy cover, BCH are left wondering how property owners can afford not to protect themselves properly, looking at both declared values and inflation provisions within policies.

Nobody wants a claim and none of us can predict, if or when, that might occur. But if the unpredictable happens, the last thing you want to discover is underinsurance. At that time, it is too late to correct. If there was ever a time to undertake an RCA or Benchmark, it is now. Furthermore, even if you’ve undertaken one recently, at the annual policy review you should consider what might have happened to costs for your type of property since the last RCA with your insurance professional.

More than ever, the approach to insurance valuation needs to be dynamic and the answer may well be more regular reviews until a degree of normality returns, which at the time of writing is predicted by many commentators…but for now we can look at all these predictions and make a judgement. We haven’t quite resorted to using a crystal ball!

Speak to the Buildings Insurance Valuation experts

If you're looking for a practice that focuses exclusively on buildings insurance valuations, you've come to the right place. We survey all types of property from private homes and blocks of flats to commercial and industrial premises.