The hard market in insurance is undoubtedly leading to higher premiums and a tougher stance on claims. This is not a good time to be underinsured, as policyholders may suffer a shortfall in pay-out on an otherwise valid claim at a time they can least afford it.

Martyn Barrett BSc MRICS ACII FCILA FUEDI-ELAE, Director, Barrett Corp & Harrington

The majority of well- known insurers in the UK are multi-national, composite businesses with hugely diverse operations. Most offer cover for property, motor, health, liability, engineering etc as well as owning their own property portfolios. Putting it very simply, they make their living by balancing their assets and liabilities in the process delivering profits for shareholders, whilst paying claims.

Insurers are having a tough time, like most businesses and individuals, as we emerge into a post pandemic world. The insurance market was already under pressure pre Covid 19. Many factors were aligning over a period, all of which were squeezing margins and forcing the large composites to become ‘harder’ rather than face losses.

Insurance is often considered a grudge purchase for householders and businesses alike. This can, in part, be because the cost tends to rise and these days you don’t even get a piece of paper in return! Premiums are often a significant budget aspect but, statistically it is unlikely that it will ever give a return as most people don’t ever have to make a claim. BUT, if a big claim does come along, insurance could be the best investment ever made by any of us.

In short, we can’t live without the ‘peace of mind’ that a good insurance policy brings.

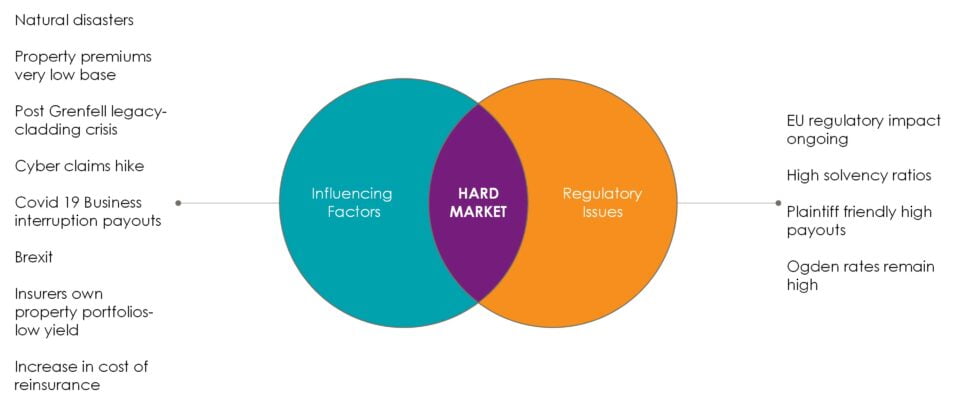

As illustrated below, through 2019 and onwards, factors aligned to create an insurance market where capacity was reduced, insurers became more ‘risk averse’ or, choosy in what they offered cover on. Supply began to be outstripped by demand. Insurers found that the cost of their own reinsurance was increasing, and this combined with many other factors led to premiums increasing, cost cutting in insurance companies and other action to ensure that insurers remained profitable whilst still meeting their commitments to policyholders.

Along with a rise in almost all premiums, we also began to see our property insurance premiums increase. Behind the scenes brokers, were working hard to get the best deals from a market in which capacity was shrinking, particularly where the construction was deemed ‘riskier’ or non- standard. Reduction in capacity and resultant increases in premium, have been felt throughout.

There is another aspect of the hardening market that is emerging in insurer’s attitude to claims.

Contrary to the many urban myths, Insurers do pay claims. They contract with us to pay in the event of certain events happening- no ifs no buts- they pay. However, the whole principle of insurance is the benefit of the policy will be paid assuming you have paid the appropriate premium to reflect the risk that the insurer thought they were insuring. Here is not the place to discuss fair presentation of risk and the Insurance Act, but suffice to say that in most policies there is a direct correlation between the value declared at the time we take out the policy (and at subsequent renewals) and the premium paid. Should it be found at the time of claim that the rebuilding cost stated in the policy is inadequate then most policies have a contractual clause which allows the claim to be reduced in the same proportion that the true rebuild cost bears to the value stated in the policy. It’s called Average or proportionate settlement.

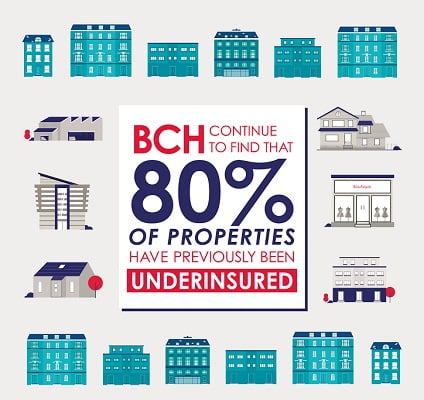

Insurers have always had the option to utilise these clauses, but historically, being keen to pay claims to maintain a good profile in a softer market, they have not enacted them. In the experience of BCH Director, Martyn Barrett, who began his Insurance career in loss adjusting, insurers seemed to accept a degree of what they called ‘claims leakage’. Underinsurance has always been out there, our own statistics at BCH after 15 years of trading still show staggeringly high levels

It may have taken the arrival of the hard market for insurers to start looking at the whole underinsurance issue more closely. BCH is now being called in regularly after a loss to check whether the insurance value was correct. This can only mean that the insurer is looking to use this to adjust the amount of claim, by applying Average or a proportionate settlement. That is very tough as the reduction in claim value will massively dwarf the amount of premium saved by not insuring for the correct value at the time the policy was taken out.

However, many insurers and brokers are also now part of a drive to educate policyholders on the importance of getting insurance values correct from the start so that problems do not occur at the time of claim. BCH is part of many of those initiatives and offers traditional RICS Compliant site-based reinstatement cost assessments (RCAs) and our market-leading, desk-based e-valuation service, Benchmark, which is increasingly being accepted by the major insurers and brokers as suitable for setting insurance values.

The hard market in insurance is undoubtedly leading to higher premiums and a tougher stance on claims. the growing volatility of construction costs throughout 2021 is likely to impact RCAs for some time, a topic worthy of its own article. This is not a good time to be underinsured, as policyholders may suffer a shortfall in pay-out on an otherwise valid claim at a time they can least afford it.

Remember that the insurance premium we all begrudgingly pay every year could end up the best investment we ever made.

The technology found in such buildings is also increasing. It is not uncommon for a quarter of the sum insured to be taken up by lighting, heating, air conditioning, audio/visual installations etc. It is worth noting that in a standard office building, the inclusion of full air-conditioning (a must have in some quarters now) can add 20% to the rebuild cost.

The technology found in such buildings is also increasing. It is not uncommon for a quarter of the sum insured to be taken up by lighting, heating, air conditioning, audio/visual installations etc. It is worth noting that in a standard office building, the inclusion of full air-conditioning (a must have in some quarters now) can add 20% to the rebuild cost.

Speak to the Buildings Insurance Valuation experts

If you're looking for a practice that focuses exclusively on buildings insurance valuations, you've come to the right place. We survey all types of property from private homes and blocks of flats to commercial and industrial premises.