We are often asked why our assessments may differ from a so-called ‘average prices’ found on search engines. At BCH we carry out fully compliant Reinstatement Cost Assessments.

We are often asked why our valuations for commercial buildings or RCAs may differ from so-called ‘average prices’ found on search engines, Building Cost Information Service (BCIS) or The Association of British Insurers (ABI) guides.

Valuations for commercial buildings

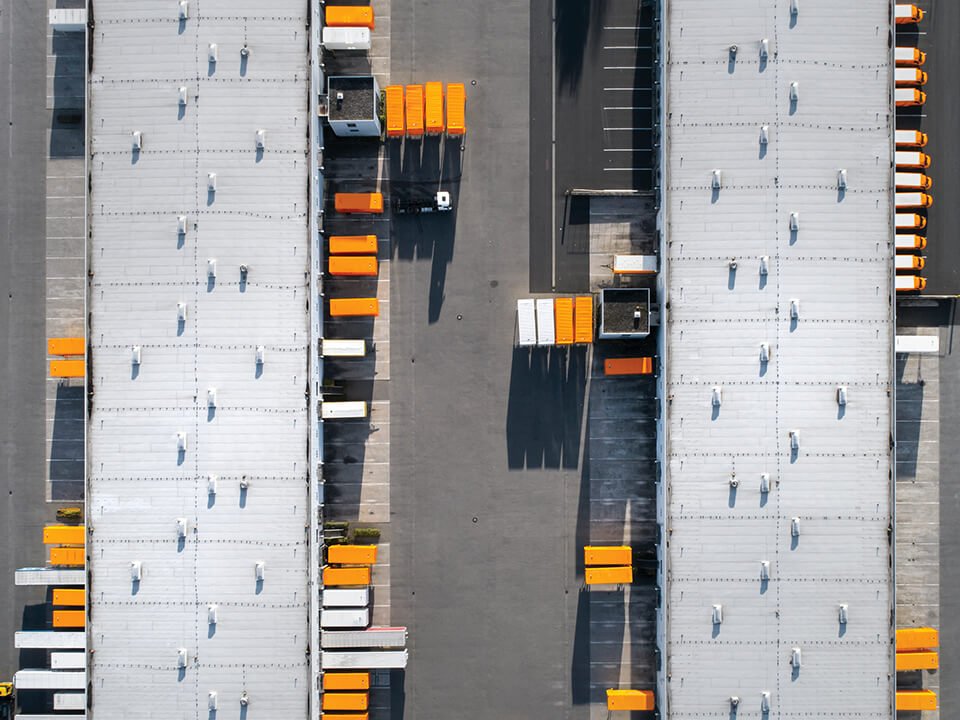

Commercial buildings can range from a converted farm building in use as a nursery to a multi-story office block.

Some of the more unusual we have been asked to assess include a historic mortuary and crisp factory (not that the two are related!) but more commonly we see light industrial units, shops, academic establishments, offices, and hotels.

At BCH we carry out fully compliant Reinstatement Cost Assessments in line with RICS guidelines*. This may mean making reference to BCIS data, but in the main, never relying on it.

Understanding the breadth of the dataset and delving into the analyses that sit behind it, is essential to using it in a meaningful way.

*RICS professional standards and guidance, UK, Reinstatement cost assessment of buildings, 3rd edition, February 2018

BCIS Average Price Data

Below are excerpts from the BCIS Average Price data as at June 2019 based on a UK mean location.

In this paper we will consider 5 key factors to explain why valuations of commercial buildings shouldn’t be based on average prices

1. Sample Size

The first thing to note is the sample size. This means the number of buildings that the data is based upon. Using BCIS data (see table above) you will note that the sample numbers differ greatly. Although useful in building up a picture, as a result of the limited sample of data these average prices may not be at all representative of the building subject to the insurance assessment.

2. When was the subject building constructed?

Since BCIS Average Prices are calculated from a dataset of buildings since 1961, they may be inappropriate for a property built before that date; or indeed more modern buildings if the samples do not include more recent projects. Materials used in the 19th century are often more expensive than the ‘go-to’ materials from today. Wood was used for windows as opposed to UPVC or powder-coated aluminium. If the subject property is in a Conservation Area or sensitive location and ‘like for like’ replacement would be appropriate, the use of traditional materials could result in a higher cost per m2 than the average price data allows.

3. Does the property include a number of different buildings?

Misuse of average prices does not allow you to make reference or differentiation between different buildings on a site which would have different functions. To take educational establishments as an example, did the school have specific sports facilities e.g. swimming pool, climbing wall and AstroTurf pitches? Were their specialist classrooms incorporating fixtures to teach food technology or soundproofed areas for music practice? Was there a small theatre or concert hall, a chapel? All of these features are found at educational establishments and would require a different approach in each case.

4. Specification does make a difference to insurance valuations for commercial buildings

For offices, a key difference in the end value will be dependent on the type of materials used and services present. For example, air conditioning and lifts would add to the cost. A variance in façade material from simple brick, to glass curtain walling and the use of a concrete or steel frame, would also increase the rate applied.

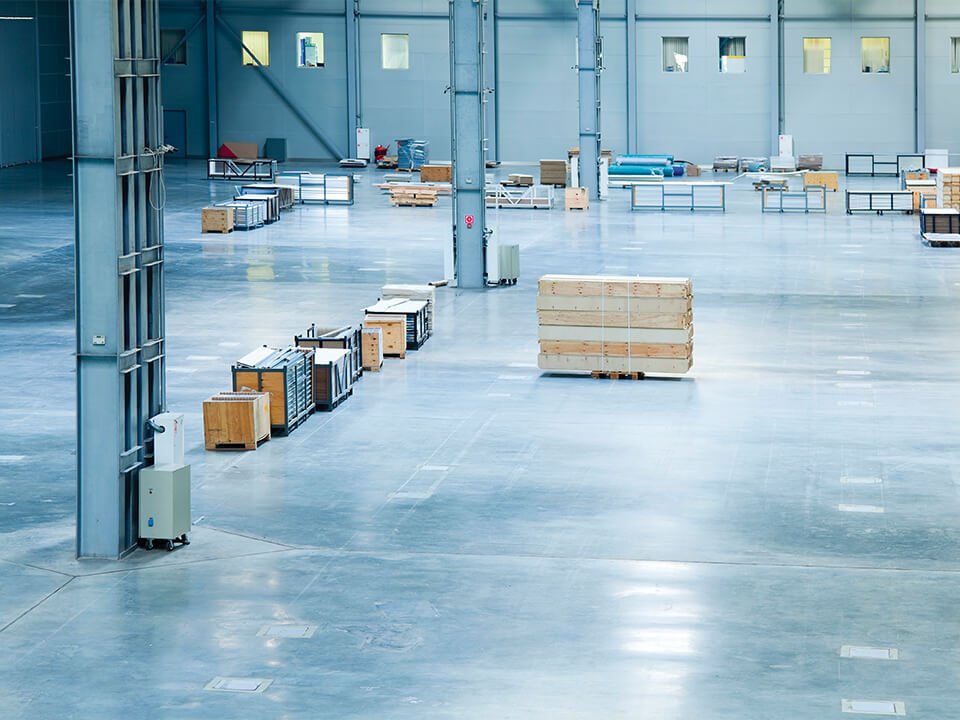

What is through the keyhole?

When looking at industrial units, huge variances can exist behind similar external appearances. The presence of mezzanine levels holding offices with appropriate heating and lighting will change an overall value significantly when you compare to a building that is largely used as a storage facility and not sub-divided in any way. The rates for warehousing in the table show that no indication is made to specific construction materials. These specifics would not be catered for if one was to rely on an assessment-driven by average prices.

Conclusion

To conclude, relying on average price data for commercial property may not always give a robust result upon which to base insurance coverage and doing so could result in a shortfall in payout at the time of a claim.

At BCH we assess each building on its individual characteristics taking into consideration its construction materials, size and specific site and location factors giving our clients confidence and peace of mind.

Is property you are involved with insuring fully covered?

If you are involved in the insurance of commercial property and would like to ensure accurate re-build values are given for building insurance cover, please feel free to call us today on 01455 293510 or contact via email, the BCH office team will be happy to answer your query.

You can also find out more about our Reinstatement Cost Assessments for commercial property here.

Download a PDF version of this BCH White Paper.

Speak to the Buildings Insurance Valuation experts

If you're looking for a practice that focuses exclusively on buildings insurance valuations, you've come to the right place. We survey all types of property from private homes and blocks of flats to commercial and industrial premises.