It’s more important than ever to keep a buildings insurance valuation up to date

With the increased construction costs and labour shortages due to COVID and Brexit exacerbating any incorrect rebuild values, it’s a particularly risky time to be underinsured.

What’s more, there is currently a ‘hard insurance market’, which means that in the event of a valid claim where a property has been underinsured, the insurer is more likely to apply the Condition of Average.

A RICS compliant Reinstatement Cost Assessment (RCA) is the most accurate method of establishing a correct rebuild value (building sum insured) for a buildings insurance policy. This will protect the policyholder from paying too high a premium as a result of being overinsured or worse, being underinsured.

Once an RCA has been undertaken, it must be reviewed on a regular basis to keep it up to date. This will ensure the insurance policy reacts in the way it is expected to in the event of a valid claim.

If changes are made to the building or its use before renewal of the policy, the building sum insured may need to be updated by undertaking a further RCA and the insurer or broker should be made aware.

So, an RCA has been carried out, what next?

An annual review

The next time and every time that a renewal of the building insurance policy or a change of provider is undertaken, the RICS recommend an annual review to update the building sum insured – reflecting inflation. This is often something that can be done in co-ordination with the insurer or broker and they may even do this automatically.

It’s important to make an allowance in advance of renewal for changes since the original RCA.

An annual review is not sufficient every year

While adjusting the building sum insured in line with inflationary effects is adequate for two subsequent years following the initial RCA, it is less specific to the property. This is due to it being an average increase based on broad cost indices from published sources, rather than reviewing the specifics related to the property.

If an annual review is undertaken, it is possible that the property may become over insured during the two years following the RCA which means the policyholder could be paying a higher premium than necessary. If on the other hand an annual review isn’t undertaken as advised by RICS for best practice, policy penalties could be introduced and the property could become underinsured.

How to keep the building sum insured accurate after the initial RCA

Third year following the RCA:

If no major alterations have been made to the property, the RICS recommends a Major Review at year three to keep the building insurance valuation specific to the property – ensuring it is as accurate as the original RCA and RICS compliant.

A Major Review maximises the investment in the original RCA, ensuring that correct premiums are being paid and the property remains correctly insured.

Without a Major Review, there is the risk of being incorrectly insured and the benefits provided in the policy wording, such as Average Waiver, falling away. This could mean that in the event of a valid claim, the Condition of Average could be applied, a clause which calculates the pay-out in proportion to the amount incorrectly insured.

BCH’s Major Review survey is a cost-effective extension to our RICS Compliant RCA. It’s desk-based and draws on data collected from our extensive database of site-based surveys and external industry recognised sources. A much more rigorous process than just annual index linking.

Fourth and fifth years following the RCA:

Between a Major Review and the sixth year from the original RCA, it is recommended that the practice of an annual review is followed.

This of course means that it is possible to drift away from the very specific building sum insured figure to an average figure based on inflationary effects and could result in incorrect buildings insurance premium being paid.

Sixth year following the RCA:

On the 6th anniversary of the original RCA, BCH recommend that our Building Insurance Surveyor revisits the site to re-appraise the property by undertaking a full review of both the property itself and any external influencing factors that may have changed.

This is much like the original RCA but conducted at a discounted rate to keep the buildings insurance valuation accurate and up to date.

An RCA doesn’t last forever

In this article, we have covered what needs to be done in the six years following the original RICS compliant Reinstatement Cost Assessment – to ensure that the buildings insurance valuation remains specific to the property to avoid over or underinsurance.

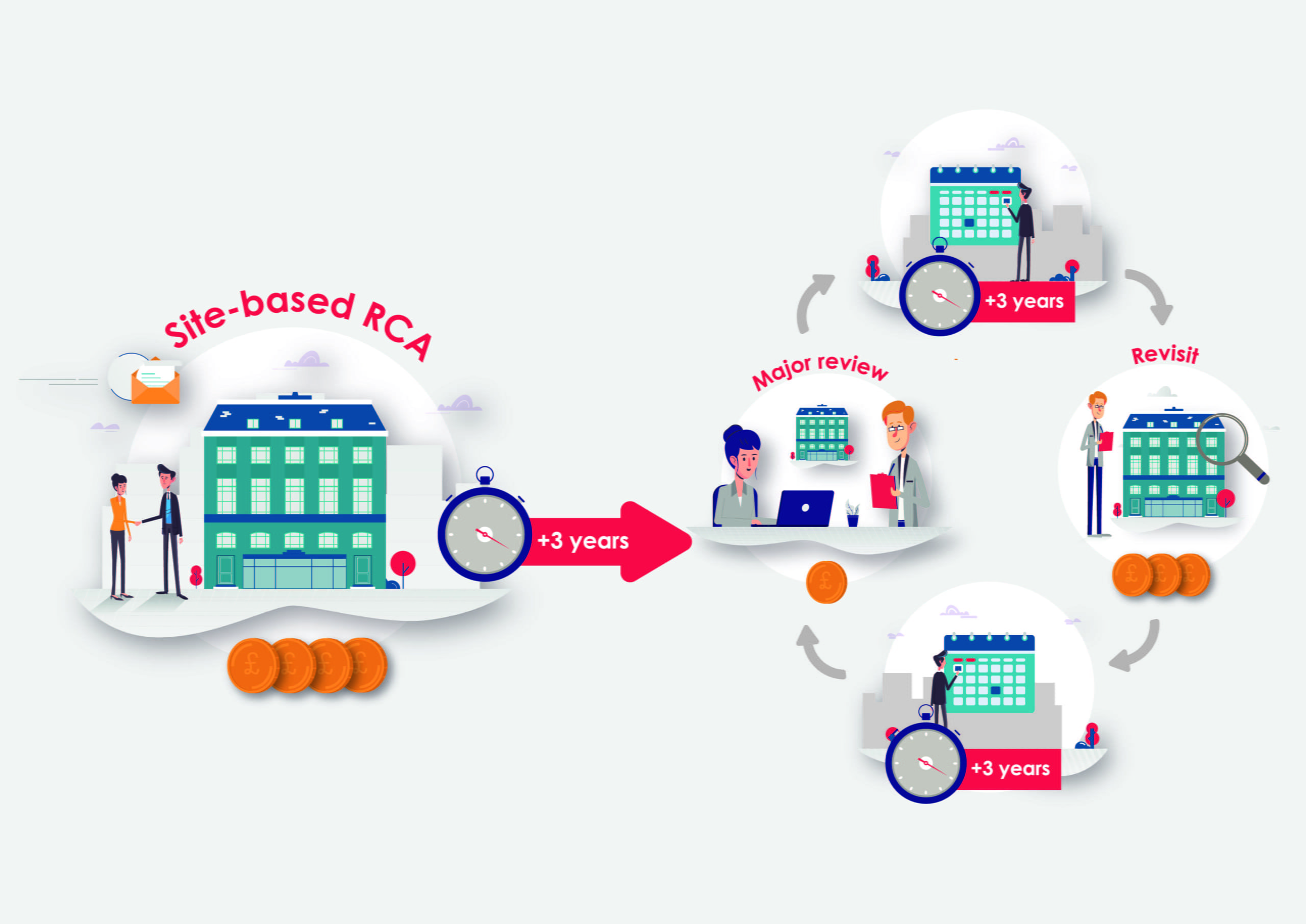

In the subsequent years, it’s recommended to follow a similar process which we refer to as the ‘BCH RCA lifecycle’ – it is essentially a continuous loop of Major Reviews and Revisits every alternate three years. This is the process recommended by RICS to keep the buildings insurance valuation compliant and accurate.

As a BCH customer, following the ‘BCH RCA lifecycle’ will give access to discounted rates and will avoid both over insurance (paying too high a premium) and underinsurance (a reduced pay-out in the event of a valid claim).

Here’s an illustration of the process:

Free Download

For a quick reference, download our guide to Keeping Your Building Insurance Valuation up to Date. It’s intended for anyone with a RICS compliant RCA.

You can download the full version of this whitepaper here How to keep a buildings insurance valuation up to date.

If you need to arrange either a Reinstatement Cost Assessment, Major Review or Revisit, please call us on 01455 293 510 or email info@BCH.uk.com.

Speak to the Buildings Insurance Valuation experts

If you're looking for a practice that focuses exclusively on buildings insurance valuations, you've come to the right place. We survey all types of property from private homes and blocks of flats to commercial and industrial premises.